Econometer: Is a Netflix-Warner Bros. merger bad for the entertainment industry?

Published in Business News

Netflix recently agreed to buy Warner Bros. Discovery for $72 billion, which would create an entertainment juggernaut — and kicked off a fair share of criticism.

The deal would mean the streamer would own some of the biggest franchises in the world: DC Comics, “Game of Thrones,” “Harry Potter,” “Looney Tunes” and more.

Critics argue the deal would make Netflix too dominant in the entertainment industry, could mean fewer movies in theaters in favor of streaming at home, and potential price increases for Netflix because consumers will have fewer options.

Theater industry groups and the Directors Guild of America expressed concern about the deal. Cinema United CEO Michael O’Leary said the transaction “poses an unprecedented threat to the global exhibition business.” On the other hand, fans of some of the Warner Bros. franchises said they were relieved Netflix pulled ahead of Paramount, which had also been trying to buy Warner Bros.

Note: After the Econometer panel was asked this question, Paramount launched a hostile bid worth $108.4 billion for Warner Bros. The Warner Bros. board said this week it was reviewing the proposal but would not modify its recommendation that assets be sold to Netflix.

Question: Is a Netflix-Warner Bros. merger bad for the entertainment industry?

Economists

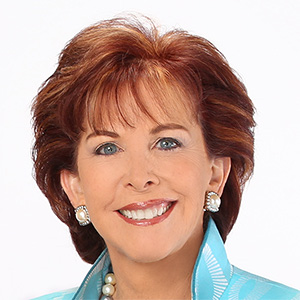

Kelly Cunningham, San Diego Institute for Economic Research

NO: While a substantial investment and risk for Netflix, the deal makes sense to expand their operations by acquiring Warner Bros. movie production studios and extensive film library. Mergers and acquisitions happen all the time, including Warner Bros.’ recent merger with Discovery. The dynamic environment of evolving consumer entertainment tastes and significant advances in technology create constant opportunities for changes to business processes. These processes must satisfy consumer desires and demand or will fail.

Alan Gin, University of San Diego

YES: The trend is toward consolidation in the entertainment industry. If Netflix doesn’t acquire Warner Bros. Discovery, Paramount probably will. Either deal would create an integrated entertainment conglomerate, with strengths in both the production side and the distribution side (through streaming). This would give the company significant market power. There could also be negative impacts on employment, both on the production side and in terms of negative impacts on movie theaters, if more content is released via streaming.

James Hamilton, University of California-San Diego

YES: A merger of direct competitors always raises antitrust concerns. Netflix and Warner Bros. compete directly in both streaming and producing new entertainment content. I am particularly concerned about consolidating so much movie and series production into a single behemoth company. Representatives of those who work in the entertainment industry, including the Writers Guild of America, the Screen Actors Guild, the Producers Guild of America and the Teamsters Union are all rightfully alarmed.

Norm Miller, University of San Diego

YES: It seems that such a merger will result in a 33% or higher streaming market share for the combined firms and that is almost certainly going to result in less competitive pricing, less future innovation and less bargaining power for producers and writers. The DOJ has used any Herfindahl-Hirschman Index above 200 in the past to signal anticompetitive concentrations, and the merger would result in a +336 points on such a scale. That’s too high.

David Ely, San Diego State University

YES: Consolidation within an industry already dominated by a small number of firms can be expected to lead to fewer jobs for workers, higher prices and less content for consumers. But even if Netflix’s acquisition of Warner Bros. is denied by antitrust regulators, a merger between Paramount and Warner Bros. will also result in increased concentration. Regulators can impose terms on the merger that may diminish, but not eliminate, some of the harmful effects.

Ray Major, economist

YES: Reduced competition in the entertainment industry will have negative impacts on many aspects of the industry. Besides antitrust concerns, the merger would negatively impact worker and creator wages, and result in corporate and production job losses. But the largest impact would be from Netflix’s algorithm-driven content model, which will reduce variety between offerings, making channels like HBO feel much more like Netflix. And lastly, prices for these services will go up due to the reduction in competition.

Executives

Phil Blair, Manpower

NO: There are savings in volume in every industry; streaming and movies are no different. There are also plenty of independent, innovative movie makers that will keep it a competitive market.

Gary London, London Moeder Advisors

NO: Such mergers are inevitable. The legacy movie companies prop up a failed movie theater model. New releases stagnate in the theaters months before Netflix and its online competitors bring the content to the overwhelming majority of people who now watch on their personal devices. Even Oscar nominations are announced well before most can access the movie. No wonder the new Paramount and Netflix are battling for change. The old model is broken.

Bob Rauch, R.A. Rauch & Associates

NO: This merger could be transformative rather than harmful. Netflix brings unmatched data-driven insights into viewer behavior, while the WB contributes a deep library of iconic content. Together, they combine scale with complementary strengths: Netflix’s analytics and global reach paired with WB’s storytelling heritage. While consolidation raises questions about competition, the industry’s stagnation suggests that bold moves are necessary. If executed well, this partnership could reinvigorate growth and deliver long-term value to both firms and their audiences.

Austin Neudecker, Weave Growth

YES: Combining Netflix and Warner Bros. further concentrates content creation and distribution in one company. While less streaming fragmentation would be nice, consolidation will drive up subscription prices, increase big-budget production and reduce opportunities for independent studios. The deal should face antitrust scrutiny and post-transaction guardrails, but a well-placed donation will likely remove such nuisances.

Chris Van Gorder, Scripps Health

NO: This is not my area of expertise, but I know the industry, particularly in L.A. and California, has not recovered from a combination of the pandemic, the labor strike and concerns about artificial intelligence. Given that, I see the possibility of this multibillion-dollar acquisition as a way to enhance consumer choice and create more opportunities for creative talent. That would be good for many in the industry, particularly in California. But this must pass regulatory review first.

Jamie Moraga, Franklin Revere

YES: A Netflix–Warner Bros. merger could harm the entertainment industry. If Netflix maintains its streaming-first model, it could further sideline theatrical releases, threatening movie theaters and smaller productions. Industry consolidation reduces competition, often leading to higher prices, job losses and less creative variety. With Netflix’s algorithm favoring mass appeal over niche storytelling, consumers could face fewer choices. The deal also raises monopoly concerns and will face regulatory scrutiny given its broad industry and consumer impact.

©2025 The San Diego Union-Tribune. Visit sandiegouniontribune.com. Distributed by Tribune Content Agency, LLC.

Comments