Simmering Trump trade war still hurting WA shipping, tourism

Published in Business News

If U.S. trade policy seems to shift by the week, the economic costs for trade-dependent states like Washington are steadily piling up.

At the ports of Seattle and Tacoma, inbound container traffic dropped substantially in May as heavy U.S. tariffs on imports from China and elsewhere led to mass cancellations of shipments.

Tourism in Washington has also taken a hit, especially from Canadians boycotting the U.S. over President Donald Trump’s tariffs and inflammatory rhetoric about making Canada the “51st state.”

Businesses and industry officials have seen some positive signs — such as the agreement by the U.S. and China last month to ratchet back tariffs for 90 days.

And some U.S. trading partners, such as Hong Kong, are remaining steadfastly neutral in the widening trade war.

But some trade experts and business leaders are skeptical that the U.S. can resolve its many trade disputes quickly enough to avoid lasting effects on everything from supply chains to hotel bookings.

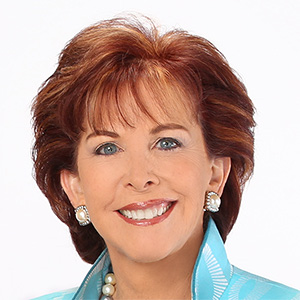

“There is … an increasing recognition that this may be a new normal for the time being,” said Laurie Trautman, director of the Border Policy Research Institute at Western Washington University, which advises policymakers on cross-border commerce.

The numbers tell a depressing story.

In May, the volume of cargo containers imported through Seattle and Tacoma dropped steadily as the effect of shipments canceled in April, due to higher tariffs, finally reached U.S. shores.

By the last week in May, imported container volume at the two ports was 33% below the average for May 2024, according to new data from the Northwest Seaport Alliance, which oversees marine cargo operations at both ports.

In 2024, China accounted for around half of imported container volume at Seattle and Tacoma, and around 40% of all trade with the ports.

Outwardly, the ports appear busier than they did several weeks ago, when it often seemed that few ships were present.

From May 19 to June 8, 40 inbound container vessels berthed at Seattle or Tacoma, just two fewer than the same period in 2024, according to data from the Marine Exchange of Puget Sound, an industry association.

But in many cases, those arriving vessels brought and unloaded fewer containers this year, port officials say.

For the last week of May, the number of containers lifted on or off a vessel at either port was down 42% from the May 2024 average, alliance data shows.

Data on May export volumes won’t be available for a week or so, but anecdotal accounts indicate that some Washington exporters continue to pause shipments while they wait to see what happens with foreign tariffs.

Many Washington businesses that have been priced out of foreign markets because of retaliatory tariffs now “worry about finding other markets,” even as their usual overseas customers are “looking at other suppliers,” said John McCarthy, commission president for the Port of Tacoma.

The picture at the U.S.-Canada border is just as stark.

Between March 1 and June 9, the number of Canadian-licensed cars crossing into Washington from British Columbia has averaged only around half of the level in the same period in 2024, according to data from the British Columbia Ministry of Transportation and Transit.

That has had a significant effect on the economies in border communities like Blaine and Bellingham, which typically see a lot of Canadian tourists and shoppers.

But it has also been felt further south by some tourist businesses in King County, where, according to the trade group Visit Seattle, Canadians spent $584 million, or 6.6% of total visitor spending, in 2024.

At the Hotel Ändra Seattle-MGallery, bookings by Canadians since March are down around 50% over 2024, while bookings by international visitors overall are down 20% to 25%, said owner Craig Shafer.

Given that Shafer had started 2025 expecting a 9% increase in international bookings over 2024, “really, we’re down over 30% from where we could be,” he said.

Port officials expected some relief in coming weeks, at least in the short term.

Since May 13, when the U.S. and China agreed to a 90-day reduction of many tariffs, scheduled sailings for vessels between China and U.S. ports have increased. In Seattle and Tacoma, port officials expect a cargo surge starting around June 16.

But McCarthy says many businesses are still reluctant to put in orders for imported goods such as holiday products without knowing whether the U.S.-China trade dispute will be settled before the 90-day pause ends in early August.

In a normal year, many retailers “have those orders being placed in May for delivery by late August to be on the shelves by Thanksgiving in time for the big buying season,” McCarthy said. But with so many trade disputes still to be resolved, he added, “there’s still a lot of uncertainty out there.”

Just last week, the U.S. raised tariffs on imported steel from 25% to 50%, potentially affecting a product category that in 2024 accounted for nearly $1.3 billion in imports through Seattle and Tacoma.

It’s a similarly complicated situation on the border.

The summer tourist season “will really be the test,” said Trautman, with the Border Policy Research Institute. “Some businesses are still hopeful that travel will recover during that peak season, although there is little to indicate that it will do so.”

As a hedge, Trautman expects many visitor-dependent businesses to try to become less reliant on our neighbors to the north by “trying to tap into the domestic market for retail and tourism.”

Still, amid all the trade conflict and chaos are some small positive signs.

Last month, a diplomat from Hong Kong visited Seattle with a surprisingly conciliatory message.

D.C. Cheung, the newly appointed director of the Hong Kong Economic and Trade Office in San Francisco, has been touring Western states as part of the office’s ongoing mission to build commerce between Hong Kong and Washington and 18 other states.

That might seem to be a fool’s errand, given the tension between the U.S. and Hong Kong, a former British Colony that is now a Chinese special administrative district.

But on matters of trade, at least, Hong Kong has some independence from China and, in Cheung’s view, has preserved its “status as the world’s freest economy,” with few trade barriers.

Case in point: Even though the U.S. has slapped the same heavy tariffs on Hong Kong as it has on China, Hong Kong, unlike China, hasn’t retaliated against U.S. products.

And in coming months, that could be a good thing for Washington, which sells the tiny region a surprisingly large number of goods, including $176 million in fish and seafood, frozen french fries, and apples in 2024.

At a time when trade with much of the world looks increasingly uncertain, Cheung said, “Hong Kong is still your good trading partner.”

©2025 The Seattle Times. Visit seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments