Wells Fargo no longer has growth restrictions. Its CFO outlines what's next

Published in Business News

Just a week after the Fed removed Wells Fargo’s $1.95 trillion asset cap punishment over its fake sales scandal, the bank’s CFO detailed new growth plans.

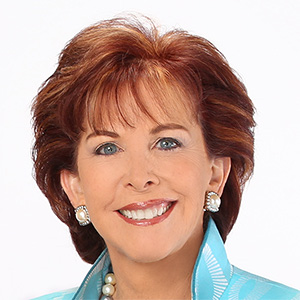

Over the past five years, risk and control work was the bank’s top priority and took up a significant amount of time, Chief Financial Officer Mike Santomassimo said at Tuesday’s Morgan Stanley U.S. Financials Conference in New York City.

Wells Fargo, which already had begun investing in refurbishing branches, is now adding wealth advisers and reintroducing incentive plans to drive growth, Santomassimo said. He did not share details about the incentives.

The company expects sustainable growth from these efforts over a long period, with a focus on products and services.

Thousands of people across the company played a role in making changes at Wells Fargo, Santomassimo said.

“It feels like a very different sort of place,” he said. “I think that we’re a very different company than we were five or six years ago. We’re excited about what’s next.”

Why Wells Fargo was punished with an asset cap

So how did Wells Fargo arrive at this point?

From 2002 to 2016, hundreds of thousands of Wells Fargo’s Community Bank employees opened millions of unauthorized or fraudulent accounts and other financial products to meet excessive sales goals.

For instance, according to details from Wells Fargo regulator the Office of the Comptroller of the Currency, one banker was “counseled” for only making 110% of their goal while a manager was getting ready to fire another banker for just hitting 105% of the goal.

Wells Fargo was slapped with several federal agency consent orders, including the 2018 Fed effectiveness and risk management order that had the asset cap. Wells Fargo has now closed 14 consent orders since 2019, including eight this year alone.

On June 3, the Federal Reserve determined that Wells Fargo had met all the conditions required to lift the asset cap, the bank’s biggest penalty stemming from the 2016 scandal.

San Francisco-based Wells Fargo has 215,000 employees, including its largest hub in Charlotte with 27,000 workers.

How Wells Fargo will begin to grow

Santomassimo said there should be growth opportunities across all of Wells Fargo’s business lines with the removal of the asset cap.

“Initially where you have more flexibility is in the markets business,” Santomassimo said. “That’s where you can do more financing-type activity with clients that will ultimately drive other business you can do with them.”

Wells Fargo expects to be more competitive growing its deposits, adding consumer checking accounts and commercial banking business, as well as expanding credit cards, wealth management and adding new clients, he said.

The bank saw a lot of attrition in its wealth management business as a result of some of the sales practices and other issues, Santomassimo said. There are new advisers in bank branches and new personal finance services.

“We’re adding wealth advisers,” he said. “And if we can do a good job in going after the wealth management business there, it also brings more banking and lending from those clients as well.”

Wells Fargo plans for consumer growth

On the consumer side, Wells Fargo has been investing in the bank branch business, refurbishing close to 2,000 of them with about another 750 this year, Santomassimo said. Along with changing the look and feel of the branches, Wells Fargo is investing in the people at those branches.

“The growth that we should see coming out of the branches should be significant over a long period of time that was somewhat impacted by the asset cap,” Santomassimo said.

Wells Fargo also is adding commercial bankers and senior investment bankers to fill in gaps and grow market share.

Its markets business has been constrained by the asset cap but will have more flexibility now, with investments in technology and people, Santomassimo said. He said they “just haven’t been able to allocate the balance sheet” they would like to that business.

With the asset cap gone, the markets business will have more flexibility to allocate capital and potentially drive growth.

Wells Fargo recently signed an agreement with Volkswagen and Audi. “The auto business is something we’ve been investing as well to become a bit more of a full-spectrum lender,” Santomassimo said.

One exception for growth priorities is residential lending, even as commercial real estate remains a significant part of of the business.

“The one place that we don’t really think of as a growth business is the mortgage business,” he said. “It’s still a very important business to clients and for us, but it’s not something that we want to be really big in.

“It’s something we want to be really good at for our clients. And we’re still in the process of right-sizing the servicing component of that business.”

©2025 The Charlotte Observer. Visit at charlotteobserver.com. Distributed by Tribune Content Agency, LLC.

Comments