The Justice Department wants to end an agreement it reached with a Pa. bank it accused of redlining in Philly

Published in Business News

Two years ago, the U.S. Department of Justice accused a Pennsylvania bank of redlining — avoiding lending in majority-Black and Hispanic neighborhoods in and around Philadelphia.

ESSA Bank & Trust, based in Stroudsburg, Pennsylvania, denied the accusations but entered into a settlement agreement with the federal government in which the bank had to give more than $2.9 million in loan subsidies to homebuyers in formerly redlined communities.

The bank also agreed to devote resources to soliciting mortgage applications from Philadelphia residents in neighborhoods it was accused of ignoring, to include Philadelphians in its program for low- and moderate-income homebuyers, to work with local groups to provide homebuyer education, and to target historically excluded neighborhoods with its advertising.

On Friday, the Justice Department asked the U.S. District Court for the Eastern District of Pennsylvania to allow it to end the five-year agreement three years early. The court filing is in line with other recent Justice Department moves across the country to end similar fair-housing and antidiscrimination settlement agreements.

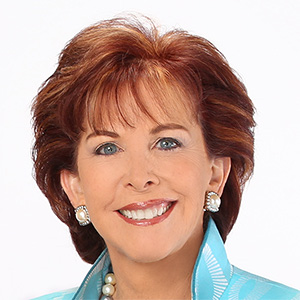

Lisa Rice, president and CEO of the National Fair Housing Alliance, said in a statement that by taking these actions, “this administration is empowering bad actors and leaving millions of our nation’s most vulnerable unprotected and exposed.”

The Justice Department said in its motion Friday that ESSA Bank “has demonstrated a commitment to remediation,” including disbursing required loan subsidies, and is “substantially in compliance” with other terms of the court order.

The bank did not respond to a request for comment Tuesday.

The department noted that its motion was “unopposed.” But on Monday, the National Fair Housing Alliance and local civil rights organizations filed a motion asking to join the case and opposing cutting short the legal agreement.

“This effort would strip West and Southwest Philadelphia communities of the hard-won protections they were promised just two years ago,” Rachel Wentworth, executive director of the nonprofit Housing Equality Center of Pennsylvania, said in a statement. “For decades, banks of all kinds have used redlining to deny neighborhoods of color access to wealth and opportunity, and ending this consent order sends a devastating message to these communities.”

The Philadelphia-based Public Interest Law Center and the law firm Stapleton Segal Cochran LLC, which has offices in Philadelphia and Marlton, are representing the Housing Equality Center, the National Fair Housing Alliance, and POWER Interfaith, the Pennsylvania faith-based community organizing network, as they oppose the Justice Department’s motion to end the agreement.

Eli Segal of Stapleton Segal Cochran said in a statement that “the rule of law demands more here than vague assurances of ‘substantial compliance.’ It demands court-ordered action.”

Olivia Mania, attorney and Penn Carey Law Catalyst Fellow at the Public Interest Law Center, said in an interview that “communities in and around Philadelphia deserve access to a lending market that’s free from discrimination.”

“This isn’t just about one bank,” Mania said in a statement. “It’s about whether the federal government will honor its role in dismantling structural racism in the housing market — or walk away when the cameras are off. The parties should be held to the terms of the consent order to ensure real, lasting change.”

©2025 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments