How one tax change in Trump's 'big beautiful bill' that even Gov. JB Pritzker supports will work

Published in Political News

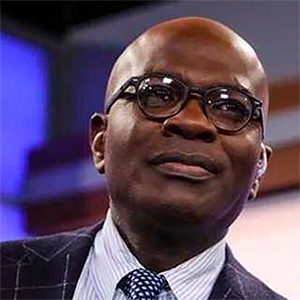

Gov. JB Pritzker and his fellow Democrats have been unrelenting in their criticisms of the tax and spending plan President Donald Trump signed July 4.

But along with much-lambasted cuts to Medicaid, food assistance and education, the budget reconciliation plan Republicans pushed through Congress this summer includes a tax change that Democrats as well as some Republicans in high-tax blue states have backed for years.

The measure temporarily raises the limit on how much of their state and local tax bills taxpayers can deduct when filing their federal income tax returns. Boosting the cap on the so-called SALT deduction to $40,000, from the previous $10,000, and extending its expiration date for five years will largely benefit those at the upper end of the income scale. But it’s also seen as especially beneficial in states such as Illinois that have high property taxes.

“I think raising it is a good thing for the state of Illinois, and I think more needs to be done to kind of alleviate the pain that the Trump administration is visiting on states across the country,” Pritzker said last week at an unrelated event in Chicago. “This is one way in which pain can be alleviated. So it’s a positive thing overall. Large states, highly populous states like ours, tend to benefit from the SALT deduction, so whatever is good for the state of Illinois, I’m for.”

Supporting the higher limit puts Democrats, who’ve decried the Republican plan as a boon for the rich, in an awkward position since it largely affects high earners. Yet it can also be good politics for those representing districts that span some of Chicago’s wealthier neighborhoods and suburban communities — areas that have become increasingly Democratic in recent decades.

The overall impact of the change, particularly for middle- and upper-middle-income homeowners in the city and suburbs, remains to be seen, however.

Trump’s new tax package leaves in place a higher standard deduction that was enacted alongside the original $10,000 SALT cap as part of his 2017 tax cuts. The higher standard deduction — $31,500 for married couples on 2025 taxes that will be filed next spring — makes it less likely households with property tax bills in the low five figures would choose to itemize on their federal returns and claim the SALT deduction.

Because of that and other intricacies of the tax code, the effect of the change on individual tax bills in Illinois is likely to be very narrow, said Ralph Martire, executive director of the Chicago-based Center for Tax and Budget Accountability, a nonpartisan think tank.

According to his group’s analysis of the 2017 change, “only 11 of the 1,229 ZIP codes in Illinois saw a majority of their taxpayers pay higher federal income taxes under the (SALT deduction) cap of $10,000,” Martire said.

And as might be expected, those ZIP codes are concentrated in affluent suburbs such as Hinsdale and Wayne in DuPage County, Lake Forest, Barrington, Highland Park and Deerfield in Lake County, and Glencoe, Kenilworth, Winnetka, Wilmette and Western Springs in Cook County.

“There are communities that disproportionately impacts … and they are communities of wealth, for the most part,” Martire said.

Still, Martire said, the previous cap of $10,000 likely put the squeeze on some upper-middle income families — think those earning around $250,000 per year, with a five-figure annual property tax bill and hopes of sending their kids to college without the help of need-based financial aid.

“You’re upper-income … at that level, but you’re not living entirely high on the hog,” Martire said.

“The truth of the matter is, from a policy standpoint, if you’re going to have a cap, the cap should be relatively high, and maybe even higher than $40,000, so that those paying a higher overall tax bill are those at the very top of the scale,” he added.

Taxpayers have been able to deduct what they pay to state and local governments since the permanent federal income tax was adopted in 1913. While policymakers have been chipping away at the deduction for decades, the $10,000 cap instituted in Trump’s 2017 Tax Cuts and Jobs Act was the most stringent restriction to date, though it didn’t meet the Trump administration’s and congressional Republicans’ original goal of eliminating the deduction entirely.

Before the 2017 change, taxpayers, with a few exceptions, could deduct from their federal taxes the full amount they paid in local property taxes as well as either state income or sales taxes. Pritzker last week said the cap “never should have been put in place in the first place.”

Republicans who pushed for eliminating or at least limiting the deduction argued that the policy was a federal tax giveaway to Democratic-led states that had made political decisions to impose higher levies on their residents. Many Democrats in states such as New York, California and Illinois opposed the cap, arguing that their residents already send a greater share of tax dollars to Washington than their states receive back and that limiting the deduction would result in some people being taxed twice on the same income.

The new cap became a contentious issue in some congressional races in the 2018 midterm election, particularly in suburban districts. U.S. Rep. Sean Casten of Downers Grove, for instance, campaigned heavily on the issue in his successful bid to unseat GOP Rep. Peter Roskam, a six-term incumbent from Wheaton who helped write the legislation creating the $10,000 cap.

When Democrats took control of the House in 2019, they passed legislation that would have eliminated the cap. The measure was not taken up in the Republican-led Senate, though support for the limit didn’t break cleanly along party lines.

After Democrats took control of the Senate in 2021 with President Joe Biden in the White House, efforts to address the cap again faltered, despite efforts by Pritzker and other Democratic governors who wrote Biden a letter that spring calling for it to be eliminated.

“Like so many of President Trump’s efforts, capping SALT deductions was based on politics, not logic or good government,” the letter said.

“This assault disproportionately targeted Democratic-run states, increasing taxes on hardworking families,” the governors said.

Eventually, however, the issue was left by the wayside as the Biden administration worked to cobble together support for his scaled-down domestic policy agenda, in large part because eliminating the cap would have cost the federal government roughly $100 billion in lost revenue annually.

Once Republicans took back control of Congress and the White House in the 2024 election, the GOP was forced to grapple with the issue as Trump and his supporters worked to push through his sweeping One Big Beautiful Bill Act.

With few votes to spare thanks to a razor-thin majority and unified Democratic opposition to the overall package, several House Republicans from Democratic-led states, though none of Illinois’ three GOP members, threatened to withhold their support if a higher limit for the state and local tax deduction wasn’t included. Without any action from Congress, the cap would have expired completely at the end of the year.

In the end, Trump signed a measure that raised the cap to $40,000 for the current year, with a 1% annual increase through 2029. In 2030, the cap will drop back to $10,000, unless Congress takes further action.

The higher cap phases out for higher-income individuals, beginning with those earning more than $500,000 but doesn’t drop below the $10,000 level for any taxpayer who claims the deduction.

Despite the effort to scale back the cap for the highest earners, only about 7% of tax filers will see a benefit from the change, according to estimates from the Tax Policy Center at the Urban Institute and Brookings Institution, research associate Nikhita Airi said. Of the overall tax savings, nearly 85% will go to the top 20% of earners, with more than half going to those in the top 10%.

“It’s a deduction with a pretty clear constituency, and that kind of explains why it’s been so politically durable and what ended up happening within the reconciliation bill,” Airi said.

Even though some Illinois Democrats have been pushing for the cap on the deduction to be raised, they weren’t in a celebratory mood when Republicans did so as part of their massive $3.4 trillion package.

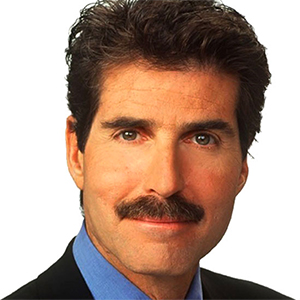

“If I served you a big bowl of poison and there’s a Skittle in it, you shouldn’t eat the Skittle,” Casten, the Downers Grove Democrat, said at a recent forum hosted by the American Civil Liberties Union of Illinois.

_____

Chicago Tribune’s Olivia Olander contributed.

_____

©2025 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments