Jill On Money: Seniors get a 2026 raise

The lone economic report of Shutdown 2025 was released to great fanfare, but don’t get used to it. When the Bureau of Labor Statistics (BLS) announced the September Consumer Price Index (CPI), which was originally scheduled to be released on Oct 15, would be released on October 24, it also said that “no other releases will be rescheduled or produced until the resumption of regular government services.”

The September report showed that the annual inflation rate ticked up to 3 percent, primarily due to a 4.1% monthly increase in the gas index. The results were slightly better than expected, but it was still the highest annual inflation rate since the beginning of the year. Tariff-impacted categories like apparel, furniture, bedding, household furnishings, and flooring are seeing prices start to accelerate.

On the services side of the economy, KPMG Chief Economist Diane Swonk notes that care industries subject to immigration labor shortages are “seeing prices rise more rapidly... Day care and childcare costs increased 1.7% during the month, the most since September 2023, and the third highest on record. Elder care at home jumped 7% during the month, its fastest on record. The data dates to 2006.”

You may be wondering why BLS workers were called back to compile this data amid the shutdown.

The answer is that each year the Social Security Administration (SSA) uses inflation data from the third quarter to calculate the cost-of-living adjustment (COLA) for Social Security (SS) recipients for the subsequent year. With the September report hot off the presses, the SSA announced that payments for 75 million Americans who receive benefits will increase by 2.8% in 2026.

To put that in perspective, the 2025 COLA was 2.5%; in the high inflation years of 2021 and 2022, the COLA was 5.9% and 8.7%, respectively; and in low inflation years like 2015 and 2016, seniors barely saw any increase (0.0% and 0.3%, respectively). Over the last decade the COLA increase has averaged about 3.1%.

The 2026 bump means that on average, Social Security retirement benefits will increase by about $56 per month starting in January. That may not seem like a lot, but an extra $672 over the course of a year helps, especially for those Americans who are living on a fixed income.

There was another notable data point that came from the September CPI report: an adjustment to the SS Earnings Test, which applies to recipients who claim benefits BEFORE their full retirement age (age 67 for those born in or after 1960) and continue to work.

The rule states that if you are under full retirement age for the entire year, the Social Security Administration deducts $1 from your benefit payments for every $2 you earn above the annual limit. For 2026, that limit is $23,480. In the year you reach full retirement age, it’s a deduction of $1 in benefits for every $3 you earn above a different limit. In 2026, this limit on your earnings is $65,160. (SSA only counts earnings up to the month before you reach your full retirement age, not your earnings for the entire year.)

The SS earnings test and annual COLA underscore why for those in good health, it usually makes sense to wait to claim your Social Security benefit until at least your Full Retirement Age (66-67, depending on the year of your birth) or to age 70, when you can receive credits for delaying filing that can boost retirement income significantly.

The higher the Social Security benefit, the more money that you can collect every year when the COLA is announced.

_____

_____

========

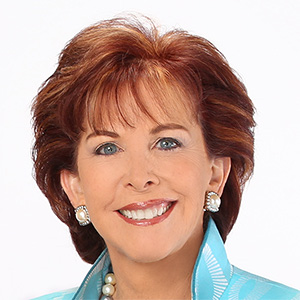

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments