Jill On Money: The US labor market is cooling

A flurry of reports puts the labor market in focus and begs the question: Are we entering a period of sluggishness?

The government’s May jobs report had headline numbers that seemed decent – 139,000 jobs added, unemployment holding steady at 4.2 percent, and wage growth increasing by 3.9% from a year ago. But when you dig deeper, there could be warning signs of an economy operating under a cloud of uncertainty.

The economy is still adding positions, and wage gains continue to outpace inflation, but job growth is moderating. The two prior months' numbers were revised lower — a combined 95,000 in total. The May results mean that in 2025, job growth has slowed to an average of 124,000 per month, down from 168,000 in 2024 and 251,000 in 2023.

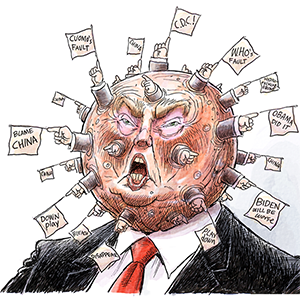

The downward trend has accelerated, as employers have become more cautious about growth prospects under the Trump administration's economic policies.

In a recent survey, the Conference Board’s Measure of CEO Confidence fell by 26 points in Q2 2025 to 34 (a reading below 50 reflects more negative than positive responses.) It was the largest quarter-over-quarter decline in the history of the survey, which started in 1976. (133 CEOs participated, and it was fielded from May 5 to May 19.)

CEOs ranked geopolitical instability, trade and tariffs, and legal and regulatory uncertainty as top concerns. When businesses are uncertain about the overall policy environment and can’t forecast the short- or long-term outlook in their industries, they hit the pause button on hiring.

That's exactly what we're seeing. Souring sentiment is likely the cause for a separate report from ADP, which found that private employers added just 37,000 jobs in May, the lowest monthly job total in over two years.

Inside that report, there were additional warning signs: Small businesses – those with less than 50 employees — actually cut workers. The Federal Reserve’s survey of economic conditions (“the Beige Book), found similar results, noting that “comments about uncertainty delaying hiring were widespread” and that Fed districts were seeing some cases of declining hours worked and overtime, hiring pauses, and staff reduction plans.

The steady 4.2% unemployment rate may also be masking an underlying issue: There are fewer people entering the workforce, due to a clamp down on immigration.

According to Diane Swonk, the Chief Economist at KPMG, there are other signs that the labor market is weakening. “The flow of those who went from employed to unemployed surged by nearly one million workers. That is the largest since April 2020.”

Swonk also notes that more people are dropping out of the labor force to beef up their education and/or training, which usually happens when the labor market weakens.

She adds that the number of applicants “who were forced to accept part-time instead of full-time for economic reasons increased. The number of people forced to cut back on their hours due to economic slack fell as multiple job holders declined... the number of job leavers fell which is another sign of a slowing labor market. People tend to stay put when they fear they can’t replace their current job as easily.”

For job seekers, the message is mixed – opportunities exist, especially in healthcare/social assistance and hospitality, which accounted for more than 90% of all job gains in May, but the market is clearly tightening.

We're in a holding pattern, with businesses playing wait-and-see while economic policy uncertainty swirls.

Even if the labor market is cooling and not collapsing, cooling can turn into freezing faster than anyone expects. The current state of flux argues for a renewed focus on your personal finances, because economic transitions rarely unfold smoothly.

_____

_____

========

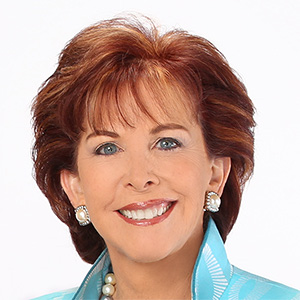

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments