California bill would mandate insurance for homeowners who reduce wildfire risks

Published in Business News

A bill requiring insurers to offer coverage to California homeowners who make their property resistant to wildfires was introduced Wednesday in the Legislature.

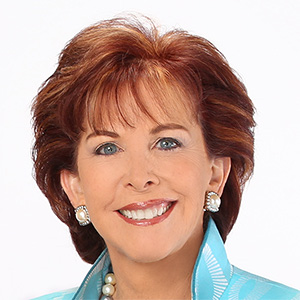

SB 1076, by state Sen. Sasha Renée Pérez, D-Alhambra, would require insurers to offer and renew coverage for any home that meets wildfire-safety standards adopted by the insurance commissioner starting Jan. 1, 2028.

The Insurance Coverage for Fire-Safe Homes Act would allow the commissioner to impose a five-year ban on insurers from operating in the state's auto and home markets if they don't comply. An insurer would also be banned from the markets for five years if it decides to cease offering property insurance under the law.

However, the bill allows insurers to seek a temporary waiver from the mandate if they can show they have an over-concentration of risk in a geographic area.

Pérez said that in her talks with survivors of the Eaton fire that struck Altadena and surrounding communities in January 2025, she found they were fearful that even if their homes are rebuilt to the highest fire safety standards, they wouldn't be offered insurance.

"To help fire survivors return home, we need assurance that newly built, wildfire-resilient homes will receive insurance coverage," she said in a statement. "Being denied coverage after meeting safety standards sends the wrong message and is akin to being penalized for doing the right thing."

The bill is co-sponsored by the Eaton Fire Survivors Network, which represents thousands of residents in the fire zone, and Consumer Watchdog, a Los Angeles consumer advocacy group that has long advocated for such a law.

A 2023 bill the group supported would have similarly required insurers to provide coverage to homeowners who reduce risks on their property, but it died in the Legislature.

Carmen Balber, executive director of Consumer Watchdog, said that the new bill has a better chance of becoming law, given that hundreds of thousands of homeowners have been dropped by their insurers over the last several years and forced onto the California FAIR Plan, the state's insurer of last resort. The plan is run by licensed home insurers and offers more limited policies at a higher cost.

Following the January 2025 fires, FAIR Plan policyholders in the Eaton and Palisades burn areas filed lawsuits against the insurer over its handling of smoke-damage claims. The California Department of Insurance also opened an investigation into its claims practices.

"The situation on the ground for consumers is so much worse, and that's why this bill should get serious consideration in the Legislature," Balber said.

The proponents also cite recent polls showing that voters support requiring insurers to cover homeowners who reduce fire risk on their properties.

The bill drew immediate criticism from the Personal Insurance Federation of California, a trade group representing major property and casualty insurers.

"The bill would require insurers to lose money in California's high fire risk areas or else be kicked out of the state. The obvious result is that it would push insurers out of the homeowners insurance market and, not to be outdone, also create an auto insurance crisis," said Rex Frazier, president of the group.

The American Property and Casualty Insurance Assn., a national trade group, said it was reviewing the bill closely and warned it could have a detrimental effect on the market.

"It's critical that policymakers proceed with caution before layering new mandates onto an already strained system, which would only deepen market challenges facing consumers," said Mark Sektnan, vice president, state government relations.

The 2023 bill would have based its wildfire safety standards on the state's Safer from Wildfires program, which was established in 2021 and offers homeowners moderate discounts for mitigation measures.

They include installing a Class-A fire-rated roof, establishing a 5-foot ember-resistant zone around a home and installing fire-resistant vents and closed eaves, among other measures.

Pérez's bill would establish home hardening and defensible space measures set by the insurance commissioner, though Balber said she expects the Safer from Wildfires program would "inform" the new standards.

This is the third insurance-related bill that Pérez has introduced this year co-sponsored by the two groups.

SB 877 would require insurers to provide more transparency in the claims process. SB 878 would impose a penalty on insurers who don't make claims payments on time. Neither bill has been heard by a committee yet.

©2026 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments