Warner Bros. Discovery board faces pressure as activist investor threatens to vote no on Netflix deal

Published in Business News

Activist investor Ancora Holdings Group is calling on the Warner Bros. Discovery board to consider a revised bid from Paramount Skydance and negotiate with the David Ellison-led company, or it says it will vote no on the proposed deal between Warner Bros. and Netflix.

The Cleveland-based investment management firm released a presentation Wednesday detailing why it believes Paramount's latest offer could be a superior bid compared with the Netflix transaction.

Ancora said its stake in Warner Bros. Discovery is worth about $200 million, which would make its ownership less than 1% given the company's $69.4-billion market cap.

Ancora cited uncertainty around the equity value and final debt allocation for the planned spinoff of Warner's cable channels into a separate company as a factor that could change share valuation. The spinoff is still set to happen under the agreement with Netflix, as the streamer does not intend to buy the cable channels. Paramount has proposed buying the entire company.

The backing of David Ellison's father, Oracle co-founder Larry Ellison, was a sign of the Paramount bid's "credibility and executability," Ancora said, adding that it had concerns about the regulatory hurdles Netflix could face.

Senators grilled Netflix Co-Chief Executive Ted Sarandos last week about potential antitrust issues related to its agreement to buy Warner Bros. Sarandos has said 80% of HBO Max subscribers in the U.S. also subscribe to Netflix and contended that a deal between the two would give the combined company 20% of the U.S. television streaming market, below the 30% threshold for a monopoly.

The investment management firm noted that Paramount is "reportedly viewed as the current administration's 'favored' bidder — suggesting stronger political support," a nod to the Ellison family's friendly relationship with President Trump.

Trump has vacillated in his public statements on the deal. In December, he said he "would be involved" in his administration's decision to approve any agreement, but last week, he said he "decided I shouldn't be involved" and would leave it up to the Justice Department.

"Paramount's latest offer has opened the door," Ancora wrote in its presentation. "There is still a clear and immediately actionable path for the Hollywood ending that all [Warner] shareholders deserve."

Ancora said it intends to vote no on the Netflix deal and that it also could seek to elect directors at the upcoming Warner shareholders meeting.

Warner said in a statement that its board and management team "have a proven track record of acting in the best interests of the Company and shareholders" and that they "remain resolute in our commitment to maximize value for shareholders."

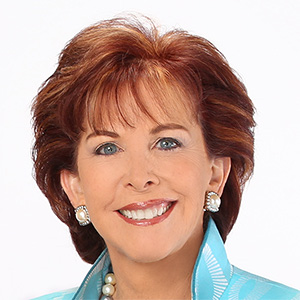

Ancora's presentation does highlight "two primary questions as shareholders approach this deal," said Alicia Reese, senior vice president of equity research for media and entertainment at Wedbush.

"The biggest question mark is what is Discovery Global worth?" she asked. "The second is how likely is Netflix to pass regulatory scrutiny."

The firm's opposition doesn't necessarily mean the Warner board will change course, but if other significant shareholders take a similar stance, the board likely would need to "meaningfully and proactively engage further to seek more money," said Corey Martin, a managing partner at the law firm Granderson Des Rochers.

"If I were Paramount ... I would view this as a tea leaf that there might be a little bit of an opening here, to the extent we were to be aggressive," he said. But, "if Paramount wants this company, it's going to have to blow the Netflix bid out of the water so that there's no question to the shareholders which bid represents the most value."

©2026 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments