As restaurant traffic slows, Portillo's lowers guidance, slows store openings, ends breakfast experiment

Published in Business News

Portillo’s, famous for its Italian beef, Chicago-style hot dogs and decadent cake shakes, is thinking leaner in terms of business expansion.

Facing an increasingly tough restaurant environment, the Oak Brook-based chain lowered same-store revenue projections for the year and announced a revised growth strategy focused on its core markets and menu offerings, simplified operations and a slower pace of new openings.

“We want to be driving traffic,” Michael Osanloo, Portillo’s president and CEO, said during a Piper Sandler conference Wednesday. “I also think that this slowdown in order to reset our development is hugely important for us.”

While not quite going back to its humble hot dog stand roots, the revised growth strategy for Portillo’s includes cutting the number of openings planned for 2025 from 12 to eight, shifting to smaller-format stores and ending the Chicago breakfast experiment, among other initiatives.

Like many restaurants, Portillo’s saw flat same-store sales and declining traffic in the second quarter, with the downward trend worsening in recent weeks, Osanloo said at the conference.

“Systemwide, we’ve seen a tough last four or five weeks,” he said at the conference.

The iconic restaurant chain has been struggling to recapture its Chicago street-food mojo and conquer new markets for several years.

Launched as a Villa Park hot dog stand in 1963, Dick Portillo expanded his menu to include Italian beef, burgers, salads and more, and built his chain to 38 restaurants in Illinois, Indiana, California and Arizona before selling to private equity firm Berkshire Partners in 2014.

When Portillo’s went public in October 2021, it had 67 restaurants in nine states, raising $405 million through the offering with an ambitious plan to expand to 600 locations nationwide.

Since then, Portillo’s has grown to 95 company-owned restaurants in 10 states, but its stock has fallen about 87% from the post-IPO high and the chain has been under pressure from activist investors Engaged Capital over concerns about flat sales and expensive restaurant buildouts.

In June, Portillo’s added Eugene Lee, former CEO and chairman of Darden Restaurants, as a director at the recommendation of Engaged, which previously helped get former Chipotle executive Jack Hartung nominated to the board in January.

Engaged had a slightly reduced 6.7% stake in Portillo’s as of the second quarter.

“It’s a blessing to have guys like Jack Hartung and Gene Lee on our board,” Osanloo said during the conference. “I talk to them weekly. It’s making me better. It’s making the company better. They’ve been incredibly helpful on this whole reset process, and their fingerprints are all over it.”

The changes include the end of the great breakfast experiment, which was rolled out at five Chicago-area Portillo’s locations in April. The offerings included a pepper and egg sandwich — a seasonal Chicago favorite during Lent — but it failed to make much of a dent against the Egg McMuffin among the fast-food breakfast crowd.

David Henkes, senior principal at Chicago-based food service research firm Technomic, said launching a breakfast menu can be challenging for a lunch-and-dinner restaurant.

“Breakfast is a very routine-oriented day part, it’s very convenience driven,” Henkes said. “I think it just had trouble breaking through the clutter. And I think operationally, it’s very difficult for them to manage.”

Onsaloo said the Chicago test breakfasts did well, and will be part of the menu at a new Portillo’s launching next year at the Dallas Fort Worth International Airport. But ultimately, it proved a distraction to the core mission.

“We’re going to have breakfast when we open in the Dallas Fort Worth airport early next year — we have to have a breakfast offering,” Onsaloo said. “So we’ve learned a lot that we will quickly deploy there, but it’s also, to me, undeniable that it’s taking away our attention from driving traffic at lunch and dinner, which pays all the bills at Portillo’s.”

Slowing down the expansion of Portillo’s into new markets is also key to the reset. The chain, which opened 10 restaurants last year, plans to add eight this year — four fewer than the original target — and eight next year, including six already under construction.

Portillo’s is also building smaller restaurants as it expands, lowering construction costs to less than $5 million per store by 2026. In 2024, the 10 new restaurants cost an average of $6.8 million to build, the company said.

In addition to a smaller traditional dine-in restaurant, Portillo’s has launched three takeout-only locations in the Chicago area — in Joliet, Rosemont and Orland Park — and last week announced a fourth, coming to Plainfield.

Expanding the business in new markets outside Chicago has also proved challenging. In Texas, where Portillo’s has opened a dozen stores since planting its flag in suburban Dallas in January 2023, the response to Italian beef and Chicago-style hot dogs has been less robust than expected.

Portillo’s is planning to enter the Atlanta market this year at a slower pace, with a second store planned for next year and potentially a third location in 2027, Onsaloo said.

“In Atlanta, we are purposefully taking a more deliberate path on development,” Osanloo said. “I think one of the things that we probably did in Texas is we did build a little bit faster than demand.”

Darren Tristano, CEO of FoodserviceResults, a Chicago-based research and consulting firm, said that while Italian beef and Chicago-style hot dogs do well in markets like Florida and Arizona, where Chicago expatriates flock for the winter or retirement, it takes more time to build up demand in Texas or other markets.

Slowing down the rollout of new stores will give Portillo’s more runway to effectively deliver that message to the uninitiated, he said.

“I think as you move outside of the Chicago market, you really have to teach people what a Chicago beef is and a really good hot dog,” Tristano said. ”In many parts of the country, not unlike pizza, it is very difficult to explain to people that this is a good hot dog, this is Italian beef, and you’re going to pay for it.”

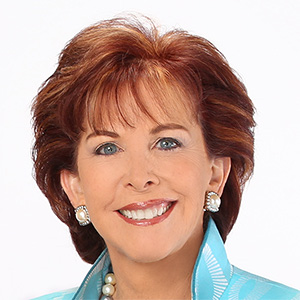

Last week, Portillo’s announced the hiring of Denise Lauer as the new chief marketing officer to deliver that message. Lauer, who previously held the same role at Marco’s Pizza, starts at Portillo’s on Sept. 22.

Beyond store size, new units and breakfast offerings, Onsaloo there’s one more thing that may need some cutting — menu prices.

In the wake of McDonald’s bringing back Extra Value Meals, restaurants are all looking at promoting value in an effort to lure inflation-weary customers and increase traffic. Onsaloo said that as competitors lower their prices, Portillo’s may need to follow suit.

“I think we have to look ourselves hard in the mirror and say: Great on quality, great on quantity, but is the absolute price point where we want to be? And we have to take a hard look at that,” Osanloo said.

©2025 Chicago Tribune. Visit at chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments