US notches worst 3 months for jobs growth since pandemic

Published in Business News

U.S. job growth cooled sharply over the past three months and the unemployment rate rose, showing the labor market is shifting into a lower gear amid widespread economic uncertainty.

Payrolls increased 73,000 in July after the prior two months were revised down by nearly 260,000, according to a Bureau of Labor Statistics report out Friday. In the last three months, employment growth has averaged a paltry 35,000 — the worst since the pandemic.

The data send a stronger signal that the labor market is weakening more noticeably. Not only is job growth cooling markedly and unemployment rising, it’s harder for unemployed Americans to get a job and wage gains have largely stalled. That poses further risks to a slowdown in consumer and business spending that’s already underway.

The report caps a week of high-profile data that show underlying economic momentum is cooling and inflation progress is stagnating, reasons why the Federal Reserve chose to keep interest rates unchanged again in a divided decision. Chair Jerome Powell maintained that the labor market is solid and the central bank needs to be wary of inflation risks — especially with President Donald Trump’s latest round of tariffs.

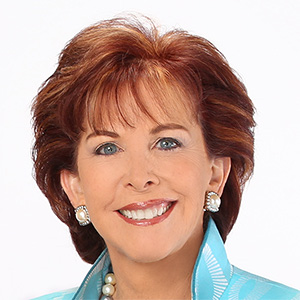

“The cracks in the labor market have widened substantially and add further pressure on the Federal Reserve to lower interest rates and support the dissenting Fed Governors’ views that the FOMC should have lowered rates this week,” Nationwide Chief Economist Kathy Bostjancic said in a note. She was referring to the Federal Open Market Committee, the panel that sets interest rates.

The S&P 500 opened lower while Treasury yields and the dollar fell as traders upped their bets that the Fed will cut rates at their next meeting in September. Officials will see another employment report and a few more on inflation before then. After the report, Trump again called on the Fed to cut rates in a social media post.

The sluggish payrolls growth reflected declines in manufacturing, professional and business services as well as government. Downward revisions to local government education payrolls contributed to the overall revisions in the prior two months. Private payrolls rebounded after barely rising in June, in large part due to health care and social assistance.

Trump’s efforts to pull back on government spending are still rippling through the job market. The federal government shed jobs for a sixth month in July, and unemployment is creeping higher in parts of the country that are hubs for government work, including the nation’s capital. The cuts have also spilled over to layoffs at universities and nonprofits reliant on federal funding.

Elsewhere in the labor market, demand for workers remains mostly healthy. Vacancies are still hovering above prepandemic levels, and initial applications for unemployment benefits have fallen in recent weeks, suggesting companies are holding on to their workers. Layoffs are generally low, though rising particularly in the tech sector due in part to the rise of artificial intelligence.

Data later Friday showed consumer sentiment rose to a five-month high in July on a recent stock-market rally, while U.S. factory activity contracted at the fastest pace in nine months.

“The main takeaway from the jobs report is that labor demand appears to be falling faster than labor supply — the labor market is not ‘solid,’ as Powell characterized it, and we expect him to revise his opinion accordingly. While a rate cut in December remains our base case, we see growing chances of an earlier move.”

The jobs report is composed of two surveys — one of businesses, which produces the payrolls figures, and another of households, which publishes unemployment and participation, among other metrics.

The participation rate — the share of the population that is working or looking for work — dropped to 62.2%, the lowest in nearly three years. The rate for those between the ages of 25 and 54, known as prime-age workers, also declined. Some economists say Trump’s immigration crackdown is pushing foreign-born workers out of the labor force, which is taking a toll on participation and also helping keep a lid on unemployment.

The rise in joblessness partly reflected more people who lost their jobs outright. The number of people unemployed for 27 weeks or longer rose to 1.83 million, the highest since the end of 2021. The jobless rate among Black Americans rose sharply also to the highest since late 2021.

Central bankers pay close attention to how labor supply and demand dynamics are impacting wage gains — especially with inflation risks poised to the upside. The report showed average hourly earnings rose 3.9% from a year ago.

______

(With assistance from Chris Middleton, Jarrell Dillard, Reade Pickert and Nazmul Ahasan.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments